Sector

Unlike businesses that have outgrown the conventional accounting, which has led to large missing chunks of value from their Balance Sheets (land recorded at historical cost, absence of internally generated brand, expensing of brand Ad Spends), banking institutions probably have the most real time Balance sheets. Since a large component of the Asset side as well the liability side is money in one form or another, an intrinsic value of a bank can be calculated with some amount of conviction.

However, these institutions have a tendency to blow up in the face of investors with small prior warning, the 2 major reasons being –

Leverage – Banking businesses have thrived on the spread of the interest earned on loans given and interest paid on deposits secured. Had it not been for regulatory caps, the return that a bank could have earned on its equity could be astronomical growing in size with the debt pyramid it builds. However, the higher the ratio of outside funds to equity, lower is the bank’s ability to withstand financial shocks. Consider this: a bank that has a leverage of 16x will run out of money if more than 6.25% of borrowers default in any given year. This threshold moves to 10% if the leverage is reduced to 9x, with returns taking a beating too.

Asset Liability Mismatch – All banks tend to borrow short duration and lend long duration in order to increase their spread. The mix is such that even the most well capitalised bank cannot withstand an onslaught of all its depositors withdrawing their money on the same day, which is what triggered the Great Depression in US in 1929. More recently in 2011, RBI had to intervene in order to stabilise ICICI Bank after rumors claiming ICICI’s imminent bankruptcy led to a run on the bank. One important intangible that banks operate on is the implicit trust that works 2 ways – banks trust that all its depositors will not withdraw money on the same day, and depositors are willing to have banks hold on to their savings. Govt. programs like FDIC guarantee in US and Indian FD guarantee upto INR 1 Lakh tend to alleviate this trust.

The instability in operations due to above 2 factors has led to significant regulatory oversight for the sector. In India, the leverage has been essentially capped through Capital Adequacy ratios, maintenance of statutory reserves of cash (CRR and SLR), limits on securitization, and mandatory lending to priority sectors.

With these parameters, best banking companies do not tend to be aggressive leveraged lenders, they tend to be the lowest cost operators who lend prudently. Cost Advantage stems from multiple parameters –

- Access to low cost deposits – CASA (Current Account / Savings Accounts)

- Low cost to income ratio.

- Creating streams of value added services at lower incremental costs. (increasing revenue per employee and per square footage) treasury operations, distribution commission, locker charges, processing fees.

What is a measure of a bank’s profitability then?

Unlike most businesses, where both Return on Equity (RoE) as well as Return on Capital Employed (RoCE) are equally important, in case of banking businesses, RoA and RoE assume much more importance than the RoCE since banking entities rely on leverage to earn excess returns on the equity deployed by them.

The components that make up RoE are as follows –

Net Margin – (PAT/Total Income)

Return on Assets – (Total Income / Total Assets)

Total Leverage – (Total Assets / Networth)

Business

We analyse City Union Bank (CUB) in this post. An institution that has been in existence for around 115 years, never once making a loss, paying dividend in all years. Headquartered in Tamil Nadu, where it also conducts significant parts of its operations. CUB is an old school banker, a conservative lender predominantly lending to MSMEs (36% of its loan book) for their working capital. Nearly 99% of its loans are secured by a collateral.

MSME Loans tend to have high yields on loans given out, and thus CUB has one of the highest yields on advances in the Indian banking system –

| Particulars | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| CUB | 13% | 13% | 13% | 13% | 12% | 12% | 11% | 11% | 10% | 10% |

| KVB | 12% | 12% | 12% | 12% | 12% | 11% | 10% | 10% | 10% | 9% |

| Federal bank | 12% | 11% | 11% | 12% | 10% | 10% | 9% | 9% | 9% | 8% |

| ICICI | 9% | 10% | 10% | 10% | 9% | 9% | 8% | 9% | 9% | 8% |

| HDFC | 12% | 12% | 12% | 11% | 11% | 10% | 10% | 10% | 10% | 9% |

| Axis | 10% | 10% | 10% | 10% | 10% | 9% | 8% | 9% | 9% | 8% |

Most of the loans it gives out are for WC purposes, and the business is driven by long term relationship between the branch manager and the borrower. Below is the RoA waterfall for the company –

| Particulars | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Interest earned on Assets | 9.5% | 10.2% | 9.7% | 9.0% | 9.2% | 8.8% | 8.7% | 9.0% | 8.4% | 6.8% |

| Other Income as a % of Assets | 1.2% | 1.1% | 1.4% | 1.1% | 1.2% | 1.1% | 0.8% | 0.8% | 0.7% | 1.2% |

| Interest Paid as a % of Assets | 6.8% | 7.1% | 6.8% | 6.2% | 5.6% | 4.9% | 4.8% | 5.0% | 4.3% | 3.6% |

| Operating Exp as a % of Assets | 1.6% | 1.8% | 1.8% | 1.8% | 2.0% | 1.9% | 2.0% | 2.0% | 2.0% | 1.8% |

| Provisions as a % of Assets | 0.5% | 0.7% | 0.7% | 0.7% | 0.9% | 1.0% | 0.7% | 1.5% | 1.5% | 1.0% |

| Pretax RoAs | 1.8% | 1.7% | 1.9% | 1.4% | 2.0% | 2.0% | 2.0% | 1.2% | 1.3% | 1.6% |

| Post tax RoAs | 1.4% | 1.4% | 1.4% | 0.9% | 1.4% | 1.5% | 1.5% | 1.0% | 1.1% | 1.2% |

| Financial Leverage | 14.0 | 12.3 | 10.3 | 10.4 | 9.9 | 9.6 | 9.4 | 9.4 | 9.1 | 9.3 |

| RoE | 20% | 17% | 15% | 10% | 14% | 14% | 14% | 9% | 10% | 12% |

As can be observed from above, the current RoEs are subdued on account of low leverage (post fund raise in 2015) and higher COVID provisioning in last 2 years. Further, CUB, like overall banking sector, has seen a lower credit growth in the last 3-4 years, as demand continues to be arrested –

| Particulars | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | Avg |

| CUB | 31% | 26% | 6% | 12% | 17% | 13% | 17% | 17% | 4% | 7% | 15% |

| KVB | 34% | 23% | 15% | 6% | 8% | 5% | 10% | 8% | -5% | 9% | 11% |

| Federal bank | 18% | 17% | -1% | 18% | 13% | 26% | 25% | 20% | 11% | 8% | 16% |

| ICICI | 17% | 14% | 17% | 14% | 12% | 7% | 10% | 14% | 10% | 14% | 13% |

| HDFC | 22% | 23% | 26% | 21% | 27% | 19% | 19% | 24% | 21% | 14% | 22% |

| Axis | 19% | 16% | 17% | 22% | 21% | 10% | 18% | 13% | 15% | 9% | 16% |

As can be observed, while average credit growth has been high for all the private players (on account of them taking away market share from PSBs), CUBs credit growth has been lagging the industry bigwigs. The same is on account of growth of housing loan and industrial credit segments, in which CUB is not present to a large extent. Further, in 2019, CUB reduced its credit growth voluntarily on account of impending slowdown in the MSME sector and the economy in general. Further, the mgmt. has been prescient in calling out lower growth for the banking sector going forward –

“From the year 2004 to 2014, the credit growth was almost three times as the GDP growth and you also had higher inflation and the sector growth rate for what do you call 17%-18% and all were quite normal for a few years in that period. Also at that point of time there were discussions that the banking sector growth rates together itself will get into single digit for multiple reasons. One, lower inflation is settling in, number two the corporates will be driven to bond market because of the compliance of many conditions on the bank borrowing. . And the third factor was that the capital availability for public sector banks were getting lower and that’s why their contribution will start lowering which will be an opportunity for the private sector banks. Over all we may not be seeing once again that 20% growth / 18% of growth and all are going to be very tough. So the growth will come to the single digits and probably we should be stabilizing somewhere between 10% to 15% and also like say getting our ROE above 15% , so that the returned earning itself will take care of the capital requirement. I am not talking about today or tomorrow or day after tomorrow but, I’m talking for a period of let’s say 10 years.”

Assessment

Our thesis here rests on 4 parameters –

- Banks act as great inflation hedges since any increase in interest rates is a direct pass through to the borrowers, while deposit rates take some time to change. This leads to higher spreads and margins as credit growth far outpaces growth in expenses.

- Against its historical leverage of 14x, its currently operating at 9x, which gives it a significant ability to sweat its equity, along with an ability to grow its spread as the drag of excess deposits reduces.

- Conservative management with a long underwriting track record of continuous profitability and dividend for more than 100 years, especially when the new age BNPL fintechs are on their way to spectacularly blowing up.

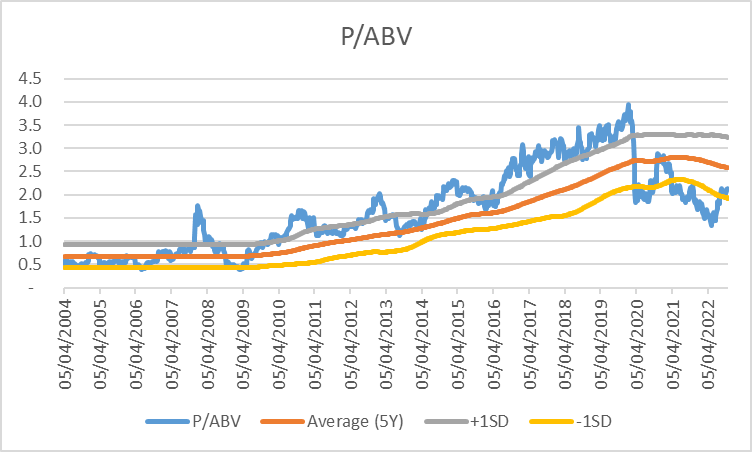

- Valuation comfort at 1.6x adjusted book, (at the time of purchase, not at CMP) 38% lower than 2.6x times it has traded on its historical average. In fact as per the trailing 5 year average, CUB was available at distressed valuations (below -1SD of 5 year average P/ABV) –

Risks

One cant have a great price without great uncertainty. SMEs, which form bulk of CUBs borrowers were impacted to an extent on account of Covid lockdowns, and its BS risk is the highest in the last 10 years –

| Particulars | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| GNPA | 173 | 293 | 336 | 512 | 682 | 857 | 977 | 1,413 | 1,893 | 1,933 |

| % of loans | 1% | 2% | 2% | 2% | 3% | 3% | 3% | 4% | 5% | 5% |

| NNPA | 96 | 197 | 233 | 323 | 408 | 475 | 591 | 778 | 1,075 | 742 |

| % of loans | 1% | 1% | 1% | 2% | 2% | 2% | 2% | 2% | 3% | 2% |

| Restructured | 235 | 352 | 260 | 289 | 251 | 153 | 131 | 276 | 1266 | 1522 |

| % of loans | 2% | 2% | 1% | 1% | 1% | 1% | 0% | 1% | 4% | 4% |

| Total Risk (NNPA + Restr) | 2% | 3% | 3% | 3% | 3% | 2% | 2% | 3% | 6% | 6% |

As can be observed, restructured assets have increased significantly. Restructured assets are loans that have got an extended repayment period, reduced interest rate, converting a part of the loan into equity, providing additional financing, or some combination of these measures. While bulk of the restructured are ones, where there has no default, this number has almost doubled the risky loans.

As per the mgmt., an option of restructuring is extended by CUB liberally to make sure that the customers tide through the crisis, and the mgmt. is confident that slippages from restructuring to NPA will be minimal. Quoting its management – “If this general situation continues, the slippages, in fact, I had even discussed in 2008, just around the Lehman crisis, when the restructuring facility was given, we had the highest restructured portfolio in the industry of which restructured portfolio, only 10 percentage slipped in the next 3 or 4 years and all.”

Even if one were to assume that 50% of the restructured accounts turn to NPA, the solvency will not get affected, while the financials will take a hit for a year.

2. Banks inherently tend to bear the brunt of government’s fiscal actions with respect to setting interest rates, infusing liquidity, changes in regulation.

3. Geographical concentration in Tamil Nadu which has 55% of CUB’s banking operations. This risk is mitigated by its long underwriting history. and despite TNs colorful image on account of its politics, it is economically India’s second largest and the most industrialized / urbanised. Even in TN, CUBs market share in advances is 3.6%, and thus there is a significant room to expand.

Happy Investing! Do get back with your comments / queries. And pls share this blog if you have found it helpful.

Disclosure: Invested at a lower price. I’m not a SEBI registered analyst and this is not a buy / sell recommendation.

wonderful analysis…More power to you Mr.Shah…

LikeLike

thank you Sunil !

LikeLike