Natco Pharma is a mid size pharma company based in Hyderabad. Company pre dominantly operates its formulations business in India (34%) and US (47%), along with API sold to third parties (13%). Further in India, Natco has carved out a niche in 2 therapies – it is the largest oncology drugmaker domestically (sells ¬30 products with a market share of ¬15%) as well as the largest Hep C drugmaker (authorised generic maker of Gilead’s bestselling Harvoni and Sovaldi in India and some developing countries, domestic market share of 40%).

US focused Companies in the Indian pharmaceutical universe can be said to have progressed in 3 waves. Companies in the first wave started exports in late 1990s and are currently the mature pharma behemoths that we know them of as today – Sun, Ranbaxy and Dr. Reddys. They have the largest number of approvals, many acquisitions, large research budgets and some amount of front end (marketing) presence in US. Next wave of pharma companies started exporting to US in 2000’s and have mostly followed in the footsteps of the established pharma companies mentioned above. Although losing the low hanging fruits in terms of large number of initial approvals and lower competition per ANDA, these companies were adept at having a low cost manufacturing base and paperwork to get their filings in order. These include Aurobindo Pharma, Zydus Cadila and Lupin.

The third wave of pharma companies started filing and operating in US only in late 2000s and early 201X and have benefitted significantly from USFDA’s decision to make the generic drugs landscape more competitive by fast tracking approvals. This wave was also spurred on by the patent expiries in the previous decade, which peaked in 2012. Natco Pharma is one of these. This simplified industry map is a necessary preamble to understanding why we are looking at Natco in the first place (since it’s a late entrant in an industry that does not seem to have a competitive advantage)

In its own words, Natco aims to create a niche through its focus on high-barrier-to-entry products that are typically characterised by one or more of the following: intricate chemistry; challenging delivery mechanism; difficult or complex manufacturing process; or that face complex legal and regulatory challenges. Simply put, a lot of the company’s pipeline is geared towards Para IV filings, which entails litigation on the validity of the patent of the innovator drug, in the US Courts of law. This is a high risk, high reward enterprise – Para IV approval leads to a 180 day exclusivity, low number of competitors, and lower price erosion (20-40%) on launch as compared to a vanilla generic (80-90%). However, it includes higher investment in litigation, R&D, marketing and time to market is also critical.

Natco mitigates this risk by tying up with larger pharma companies like Mylan and Dr. Reddys where marketing and litigation is handled by the partner while Natco handles the R&D and manufacturing. Company’s chemical skills are critical here since the approval is based on proving the filer is not violating innovator’s patents. Natco too has a strong litigation background, especially in India, where a part of its oncology portfolio growth has come from litigation through which copies of drugs like Nexavar and Gleevec were launched. Natco was also successful in wresting ‘Sovaldi’ licence from Gilead Sciences through obtaining compulsary licence in Indian Courts.

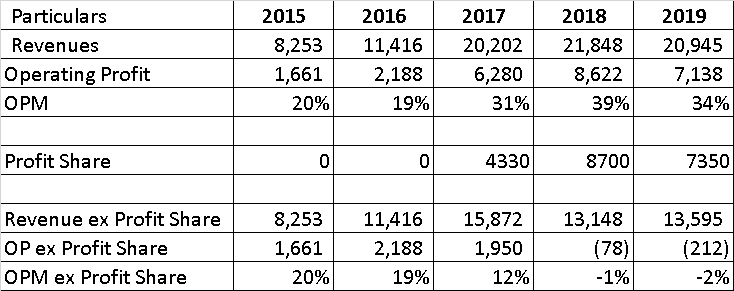

In US, Natco books revenues twice for the same drugs sold. First, it is entitled to an industrial margin (7-10%) on the raw formulations supplied by it to the channel partner, hwich is then followed by a profit share ranging from 35% – 50% of profits earned by the partner, when the drugs are eventually sold. This profit share directly hits the bottom line.

As can be seen from above, profit share has been a sizable part of financials, with 4,333 mn in 2017 coming from successful launch of the generic version of Tamiflu (180 day exclusivity, partnered with Mylan), while in 2018, it has increased to around 8,700 mn crores from sale of Doxil and Copaxone, further accruing to around 7,350 mn in 2019 (from sale of Copaxone). However, this profit share has distorted the company’s margins (especially in the last 3 years), with the base business profitability declining, possibly due to investments in future launches. Also, I have been unable to sort the disconnect of the negative OP in the last 2 years.

The timing and a rough estimate of such windfall is generally known to the market, and it can be assumed that today’s market cap of 100,000 mn INR factors profits coming from copaxone (2020), new launches in RoW and India for 2020 and 2021, and big US filings in 2022 – Revlimid, Nexavar, Everolimus).

However, company’s business in US has time and again been at the vagaries of the external shocks – ranging from a bad flu season affecting its Tamiflu revenues, significant buyer consolidation, delays in approval times co inciding with faster approvals to competitors, with the company having to re evaluate its US operations and moving to scale them down, considering Natco’s long gestation period – company’s time to market (from choosing a molecule to launch) is almost 6-8 years. Going forward, Natco would be focusing on the India, Canada and Brazil markets, along with a foray into agrochemicals segment with 1,000 mn INR of investment.

In India, Natco has a high market share in Hep C therapy, but the price erosion in drugs has led to falling revenues for the company (non exclusive licence for Sobosfuvir has been issued by Gilead to 11 Indian generic companies). In order to increase its India presence, company forayed into CVS and Diabetology segments in 2017 and has been following the practice of making niche launches. As per the company, even 2-3 such launches per year has the ability to grow the Indian portfolio by 10-15% (current portfolio is 7,200 mn in FY 18).

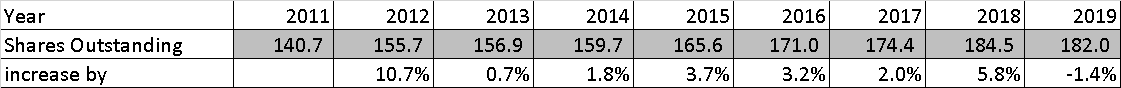

Although the leverage employed by the company in the business has been low (avg. 0.3x D/E over last 10 years), it diluted its equity multiple times over the years –

Also surprising has been the buyback in Nov 2018, where the company bought back 2.5 mn shares at 1,000 INR each after raising 10 mn shares at 915 INR each in Dec 2017.

Evaluating Natco is in the heart of conflict of sorts. It has an able and talented business manager, who has not only created shareholder value, but has also been striving to call spade a spade (its concalls give brilliant insights in the US generic market). However, can the underlying business earn above cost of capital returns over a long term? It can, and even if it does, through sheer inventiveness of its management, as a prospective investor, assessing profitability of its steady state business (OPM ex Profit share as seen above) and its future capital requirements is fairly difficult, which deprives me of the margins as well as per share denominator going forward.

Thus, although i would continue tracking the business and increase my understanding, I have been unable to arrive at a valuation with an adequate margin of safety and let the idea go.

If you, the reader, have taken a look at Natco earlier, and can think of an alternative form of valuation / understanding, feel free to comment or write to me.

Happy Investing!

The Equity Shares were bought back at an average price of INR 621.32. INR 1000 was the cap price (open mkt buyback)

LikeLike

hi Sumanth

thanks for bringing this to my notice! 1000 is definitely the cap price, and not the buyback price. The buyback happened during the month of November 2018, correct? I was checking the prices for the month –

Based on the data on moneycontrol, the share price of Natco quoted much higher than buyback price of 621 above –

Date High Low Close

Dec 2018 726 666 681

Nov 2018 801 705 715

is there a filing by Natco which gives details of the actual buy back price? i’ll correct the write up accordingly then.

Thanks again.

LikeLike